Launch Your Real Estate Crowdfunding Platform in Days, Not Months

Transform your real estate investment vision into reality with our complete white label platform. Enable fractional property ownership, raise capital faster, and deliver exceptional investor experiences—all while staying fully compliant.

Start raising capital in 7 days. Zero technical expertise required.

7 Days

Time to Launch

100%

White Label

Built-in

AML/KYC Compliance

Dedicated

Expert Support

Everything You Need to Launch & Scale Your Platform

From fractional property ownership to automated compliance, our real estate crowdfunding software gives fintechs, developers, and investment firms the tools to raise capital and deliver exceptional investor experiences.

Fractional Property Ownership & Rent Distribution

Make real estate investing accessible to everyone. Enable fractional ownership so investors can co-own properties starting from just a few hundred euros.

Investors earn passive rental income proportional to their shares. Automated monthly distributions keep them engaged and reinvesting.

- Secondary market for peer-to-peer share trading

- Custom pricing rules per property

- Automated dividend calculations

Raise Capital with Flexible Interest Rates

Finance development projects through real estate debt offerings. Control every aspect of your fundraising—from interest rates to repayment schedules.

Offer fixed or variable returns tailored to each opportunity. Build investor trust with transparent, automated interest distributions.

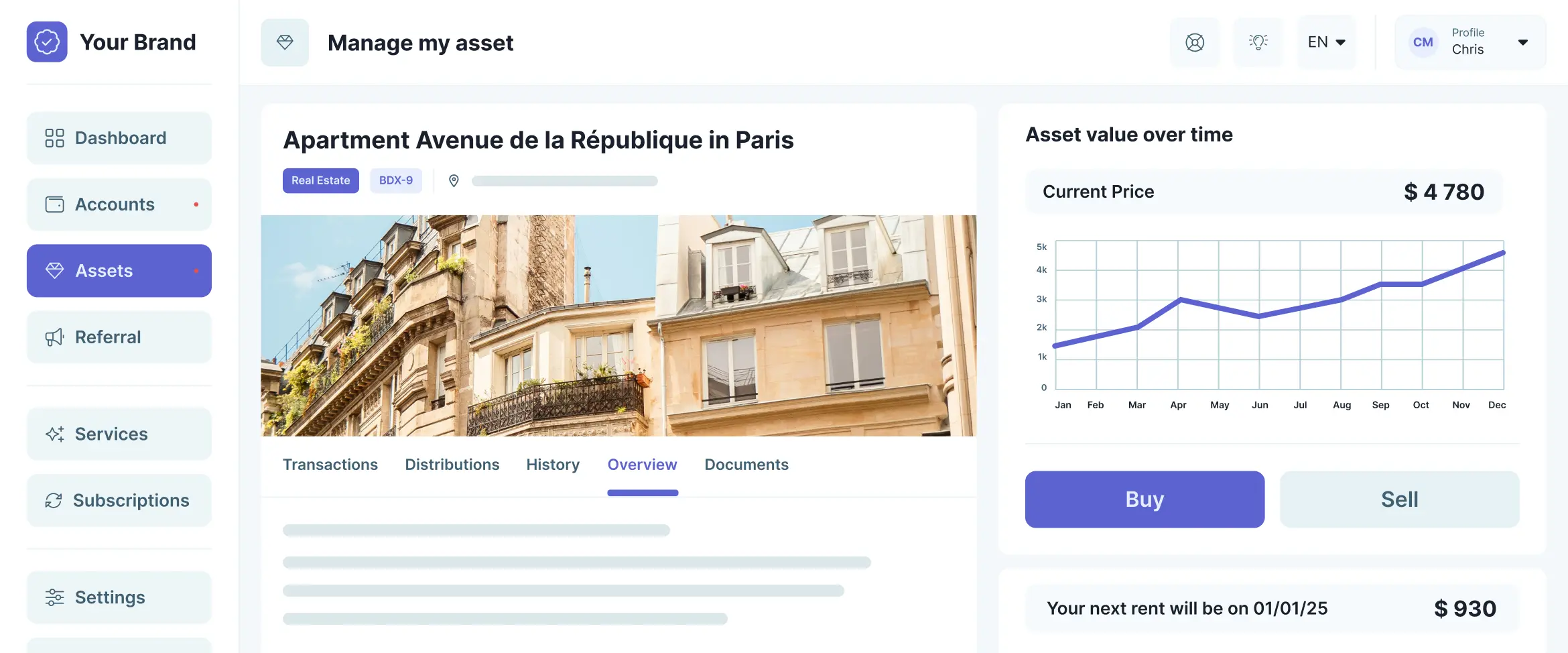

Professional Investor Dashboard

Give investors a world-class experience with personalized dashboards showing real-time portfolio performance.

Detailed analytics, new opportunities, transparent reporting, and live project updates—everything investors need to stay engaged and confident.

Automated Fund Management

Streamline all financial operations with secure, end-to-end transaction processing. Handle deposits, distributions, and refunds effortlessly.

From investor contributions to profit distributions—smooth, compliant, and transparent fund management built for scale.

Automated Documents & E-Signatures

Eliminate manual paperwork. Automatically generate subscription agreements, legal documents, and compliance paperwork for every transaction.

Integrated e-signature functionality delivers a seamless, paperless investor experience that ensures accuracy, compliance, and speed.

Launch Your Real Estate Platform This Week

Join leading real estate platforms already using our technology.

Book Your Free Demo

See how our platform can transform your real estate investment business. No commitment, no pressure.

30-minute personalized walkthrough • No credit card required

The Smart Choice for Real Estate Crowdfunding

Skip the development headaches. Get a proven, scalable platform that's already powering successful real estate investment businesses.

7-Day Launch

Go from concept to live platform in just one week. Skip months of development and start raising capital immediately.

Your Data, Your Control

No vendor lock-in. Export and migrate your data anytime. Already on another platform? We'll help you switch seamlessly.

Transparent Pricing

Pay only for what you need. Flexible pricing that scales with your business—no bloated packages or hidden fees.

Built-in AML/KYC

Stay compliant from day one with automated identity verification. Onboard investors confidently with secure KYC workflows.

100% Customizable

Your brand, your experience. Customize UI, workflows, and integrations to match your unique vision.

Trusted by Industry Leaders

Join successful platforms already using our technology. Battle-tested, scalable, and built to handle millions in transactions.

Common Questions About Real Estate Crowdfunding Platforms

Everything you need to know about launching your real estate investment platform with us.

Have more questions?

How quickly can I launch my crowdfunding platform?

How quickly can I launch my crowdfunding platform?

Most platforms go live within 7 days. Our dedicated experts handle the setup, customization, and configuration—you just tell us your requirements. No technical expertise needed on your end.

What compliance features are included?

What compliance features are included?

Built-in AML/KYC verification through Sumsub integration, automated document generation, e-signatures, investor accreditation checks, and full audit trails. Stay compliant with EU regulations from day one.

Can I customize the investor dashboard?

Can I customize the investor dashboard?

Absolutely! Every aspect is customizable—your branding, colors, layouts, and even the data displayed. We can also develop custom features specific to your business model. Your investors will see your brand, not ours.

What payment methods are supported?

What payment methods are supported?

We support bank transfers (SEPA), credit/debit cards, and can integrate with your preferred payment provider. Automated payment reconciliation ensures accurate tracking of all investor transactions.

How much does the platform cost?

How much does the platform cost?

Pricing starts at €600-2000/month depending on features needed. We offer flexible plans—pay only for what you use. New companies may qualify for a 50% discount for 6 months. Book a demo to discuss your specific needs.